The Gartley pattern is a simple harmonic pattern that is preceded by a significant low or high.

The point D is known as the Potential Reversal Zone (PRZ)įrom Point D, you can enter a trade with stops at or above (below) the price point at D. CD can also be an extension of up to 1.272% – 1.618% of XA leg. CD can be an extension of 1.618% – 2.618% of AB.  BC can retrace between 38.2% – 88.6% of AB.

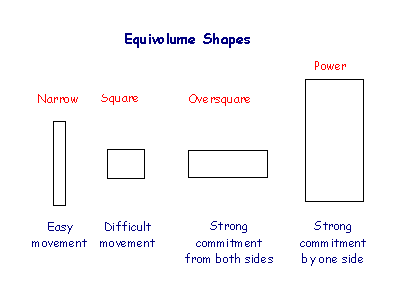

BC can retrace between 38.2% – 88.6% of AB.  AB can retrace up to 78.6% of the XA leg. The bullish and bearish butterfly patterns have the following characteristics that can be used to identify them. The pattern can form two formations: The bullish butterfly, which indicates when traders should buy, and the bearish butterfly, indicating when traders ought to sell.īutterfly patterns help traders in spotting the end of the current move so that they can take the trade. It was introduced by Bryce Gilmore and is made up of five points: X, A, B, C, and D.īelow is a diagram of the butterfly pattern The butterfly pattern is a reversal pattern that is often found at the end of a trend move. In this section, we will go through each one and outline their differences. Types of Harmonic PatternsĪlthough there are many types of harmonic patterns, only a few have stood the test of time because they form more frequently on the price charts. They are a very precise instrument, characterizing very specific price movements. Harmonic patterns are the key to identifying reversals. The main importance of harmonic patterns is to predict price movements.īy finding patterns of different magnitudes and lengths and applying Fibonacci coefficients to them, day traders can try to forecast the future movement of financial instruments like stocks, options, and more. Each harmonic patterns follows its own set of rules that will discuss in greater detail later in the article. However, each type of harmonic pattern has a different geometrical shape and Fibonacci ratio. In general, all harmonic patterns are based from 5 turning points in price. These patterns provide traders the potential reversal zone, which help to hop in reversal trades at the brink of exhaustion. Harmonic patterns are trend reversal patterns that are based on the Fibonacci extensions, retracement levels, and geometric structures. They offer a means to establish where the turning points will occur. Harmonic trading techniques utilize Fibonacci price patterns and numbers to quantify these relationships. When properly identified, harmonic patterns allow traders to enter the trade in a high probability reversal zone with minimal risk. Gartley created a pattern which he named after himself and outlined in his 1935 book, Profits in the Stock Market. The patterns were introduced to the trading world by Harold McKinley Gartley in 1932. Harmonic Patterns are a type of complex patterns that occur naturally in financial charts based on geometric price action and Fibonacci levels.

AB can retrace up to 78.6% of the XA leg. The bullish and bearish butterfly patterns have the following characteristics that can be used to identify them. The pattern can form two formations: The bullish butterfly, which indicates when traders should buy, and the bearish butterfly, indicating when traders ought to sell.īutterfly patterns help traders in spotting the end of the current move so that they can take the trade. It was introduced by Bryce Gilmore and is made up of five points: X, A, B, C, and D.īelow is a diagram of the butterfly pattern The butterfly pattern is a reversal pattern that is often found at the end of a trend move. In this section, we will go through each one and outline their differences. Types of Harmonic PatternsĪlthough there are many types of harmonic patterns, only a few have stood the test of time because they form more frequently on the price charts. They are a very precise instrument, characterizing very specific price movements. Harmonic patterns are the key to identifying reversals. The main importance of harmonic patterns is to predict price movements.īy finding patterns of different magnitudes and lengths and applying Fibonacci coefficients to them, day traders can try to forecast the future movement of financial instruments like stocks, options, and more. Each harmonic patterns follows its own set of rules that will discuss in greater detail later in the article. However, each type of harmonic pattern has a different geometrical shape and Fibonacci ratio. In general, all harmonic patterns are based from 5 turning points in price. These patterns provide traders the potential reversal zone, which help to hop in reversal trades at the brink of exhaustion. Harmonic patterns are trend reversal patterns that are based on the Fibonacci extensions, retracement levels, and geometric structures. They offer a means to establish where the turning points will occur. Harmonic trading techniques utilize Fibonacci price patterns and numbers to quantify these relationships. When properly identified, harmonic patterns allow traders to enter the trade in a high probability reversal zone with minimal risk. Gartley created a pattern which he named after himself and outlined in his 1935 book, Profits in the Stock Market. The patterns were introduced to the trading world by Harold McKinley Gartley in 1932. Harmonic Patterns are a type of complex patterns that occur naturally in financial charts based on geometric price action and Fibonacci levels.